System Support by Batteries

(More information can be found in the corresponding article in the Energiewirtschaftlichen Tagesfragen (74), publication 11, as of p. 14)

Background

In Germany, a new version of the standard balancing group contract came into force on 1 October 2024. However, one key aspect was not addressed, namely the obligation to physically balance the balancing group in accordance with Article 5 ([1], [2]). According to Article 5(1), balancing responsible parties (BRPs) are obliged to maintain a balanced quarter-hourly portfolio, which is de facto only possible under very specific conditions. Consequently, each BRP is responsible for its own balancing group and only its own balancing group.

The position paper on balancing group loyalty [3], which arose as a result of abusive behaviour by individual BRPs, places all BRPs under general suspicion of not wanting to behave in a way that serves the system. In their own interest, however, BRPs should endeavour to achieve a balanced balancing group and thus system stability. An approach based on the motto "if everyone helps themselves, everyone is helped" falls short, as shown by balancing energy prices of around EUR 15,000/MWh at the beginning of June 2024 due to a shortage of balancing capacity. Such shortages could be avoided through system-supportive behaviour and further savings could also be achieved. Measures for system-supportive behaviour by market players have long been the subject of economic and legal debate in Germany (e.g. [4], [5] or [6]).

Due to technical developments and adjustments to market rules, there are currently opportunities for the introduction of system-supportive behaviour by a large number of flexible players. The dynamic inclusion of flexibilities in other countries provides evidence how this could work. Essentially, strategies for the integration of system-supportive behaviour straddle two poles: the standalone solution, as case-based demonstrated in GB, or in combination with with more inert production or consumption units, as demonstrated in GB and the Netherlands.

The fact that system-supportive behaviour has an economic impact both from the system perspective and could be a business-case for operators also in Germany will be demonstrated below using the example of a battery. Publicly available data and information for the period from July 2023 to June 2024 are used for this purpose.

System Supportive Behaviour

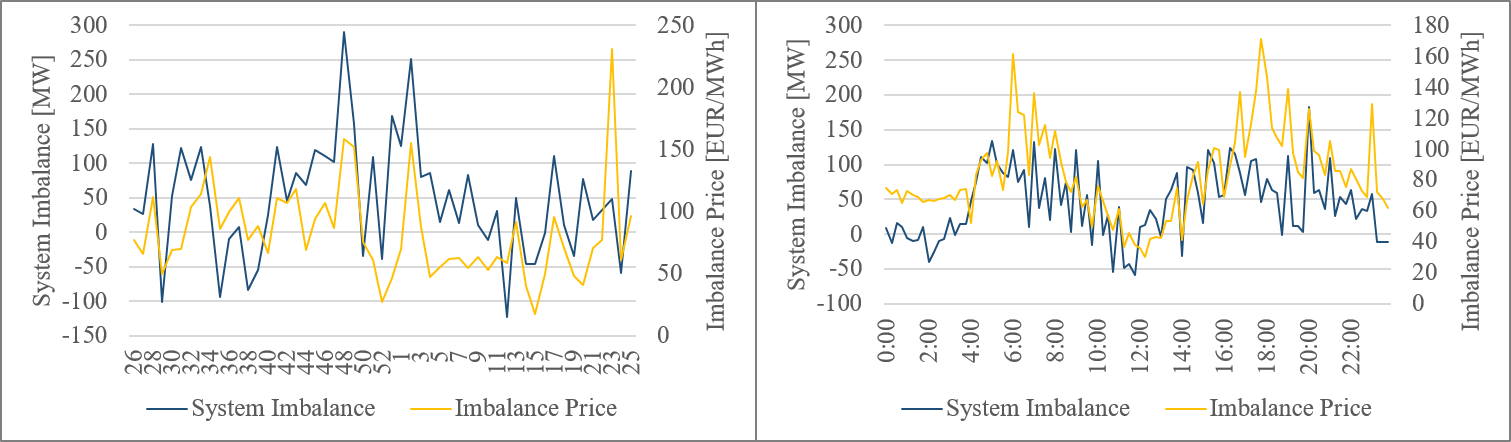

Figure 1: Development Balancing Energy

Let us first look at the development of German balancing energy (netztransparenz.de). Figure 1 shows the weekly quarter-hourly average for the NRV balance and the standardised balancing energy price across control areas on the left and the quarter-hourly average over the day on the right. The German system balance and balancing energy price fluctuate quite strongly over the weeks. Typical outliers can be seen around Christmas. The price distortions at the beginning of June 2024 with a weekly-mean balancing energy price of over 230 EUR/MWh can also be clearly seen.

Daily patterns with high morning and afternoon times and a low midday phase can be seen on the right. Due to the change of hours, the first quarter hours are also influenced by stronger fluctuations than the others. Positive and negative system deviations are fairly balanced, with an average positive deviation of 44.19 MW and a ratio of positive to negative quarter hours of 1.14. The balancing energy price is more positive at EUR 82.97/MWh and a ratio of positive to negative quarter hours of 4.20. Nevertheless, both fluctuate quite strongly. Nevertheless, both fluctuate quite strongly: on average, the quarter-hour standard deviation of the system balance is 261.36 MW. Due to the rapid adaptability of the operating mode, batteries could help to compensate for this very efficiently. This could be done on a balance group-related basis or an overall system basis.

The first option would correspond to the current legal understanding if the battery becomes part of the balancing group. This is because art. 5(1) of the balancing group contract states that the responsibility "for proper schedule management and for the economic equalisation of remaining balance deviations" lies solely with the responsible balancing responsible party.

From an overall system perspective, the second option of a system-serving buffer is more efficient. However, it is not provided for in the current contractual framework. In the sense of a commercial service, a deliberate deviation of a balancing group is supportive from a system perspective if this balancing group can heal a system imbalance more efficiently (technically easier and more cost-effectively) than other balancing groups which behave under the balancing group loyalty regime.

Determining the direction of system support

The decisive factor for option 2 is the information as to whether the German system imbalance is positive or negative in the coming or current quarter of an hour. Currently, only activated balancing service providers receive up-to-date information on the actual system status every second via the aFRR setpoint. Other market players do not receive this signal. They must estimate the direction of deviation of the German system.

For batteries, for example, the Gridradar aFRR direction forecast provides an indication. Every quarter of an hour, it provides an estimate of whether the dominant aFRR activation direction is positive or negative. aFRR was the central control power type between July 2023 and June 2024, accounting for almost 99 percent of the call-off volume. The difference between positive and negative call-off is correlated to 75 percent with the system imbalance. The Gridradar aFRR direction forecast is therefore suitable as a signal of the imbalance direction, especially as no other comparable signal is published.

The Gridradar aFRR direction forecast uses the information on the previous quarter of an hour, among other things. As soon as a TSO publishes its aFRR call-off, the aFRR direction forecast is calculated and updated every minute until the end of the quarter hour. (i) It becomes more precise with each update. The first publication already matches the actual direction of the NRV balance 65 per cent of the time. (ii) In the period between July 2023 and June 2024, the earliest publication time was between 4 and 6 minutes in more than 50 per cent of the quarter hours, and between 4 and 7 minutes after the quarter hour change in just under 80 per cent. This means that a battery would have 9 or 8 minutes to react.

In the following, a 1MW/1MWh battery will be used to show how different utilisation conditions affect system efficiency, number of cycles and profitability. For ease of illustration we assume in the following, that the battery must only used for the provision of balancing energy and must behave in a way that serves the system when capacity is available. (iii)

Showcase System Supportive Behaviour of a Battery

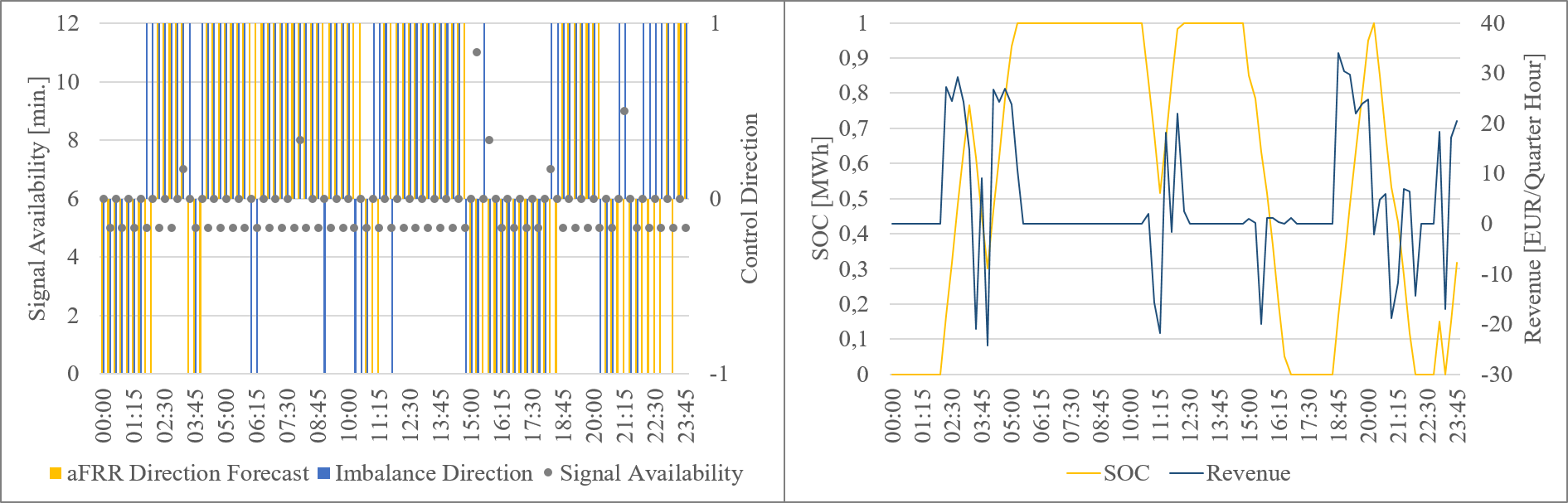

Figure 2: Charging behaviour, 19 June 2024

Figure 2 shows an example of what the charging behaviour would have looked like on Wednesday, 19 June 2024. On the left you can see the signal from the Gridradar aFRR direction forecast, the actual system imbalance direction and the time of availability of the signal, on the right the state of charge (SOC) and the revenue per quarter of an hour. The signal was usually available after 5 or 6 minutes on this day. The signal and the actual system imbalance direction were identical in 75 per cent of the quarter hours. However, it could only be used in around half of the quarter hours, as the SOC was already at 0 or 1. In addition, the battery makes a loss if it stores in the wrong direction.

In total, the battery could have saved 3.42 MWh of positive and 3.1 MWh of negative balancing energy on 19 June 2024. The total revenue would have been EUR 366.13.

Utilisation of Charging Capacity

The example demonstrates the potential of system-supportive charging for the system and the battery operator. However, it also shows that the battery was only used around half of the time. A battery operator therefore weighs up how to make the battery available. It could make sense to distribute the charging capacity over several partial cycles. By reducing the charging capacity, the battery is then available in more quarters of an hour.

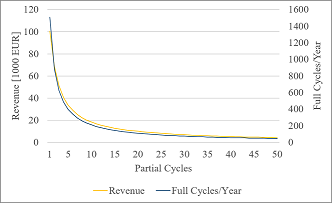

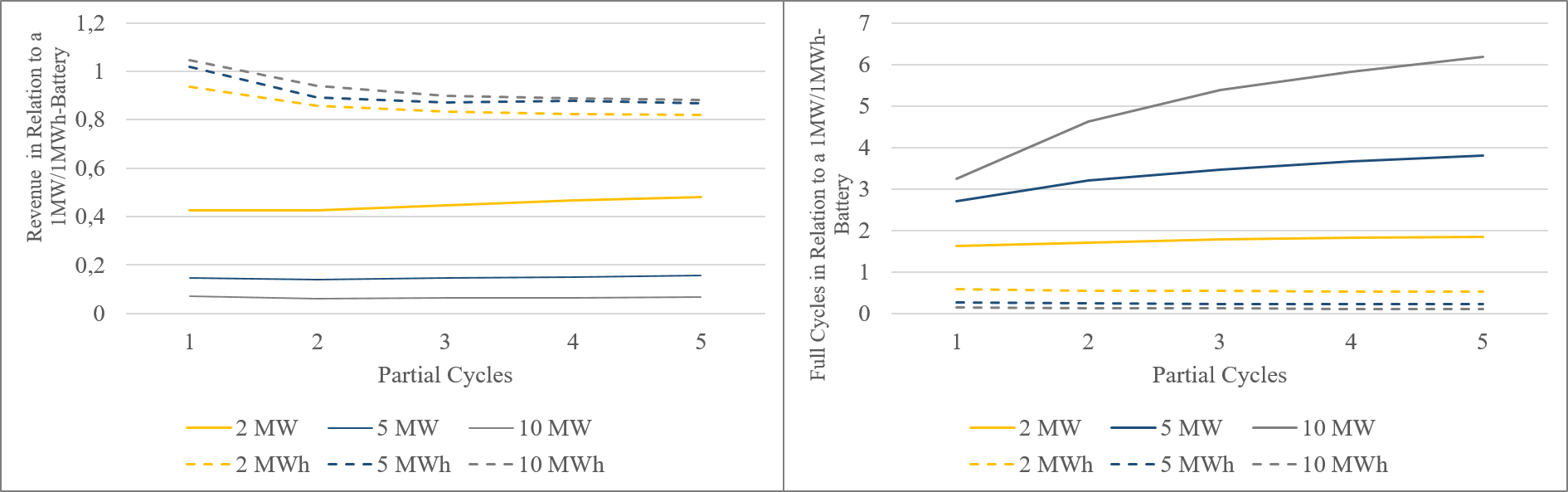

Figure 3: Impact of the Number of Partial Cycles

Figure 3 shows, however, that revenue decreases as the number of partial cycles increases. (iv) Reducing the output capacity therefore does not make sense from an annual perspective. On the other hand, a high power capacity reduces the number of full cycles. Therefore, a battery with cycle-dependent degradation can be utilised for longer with more partial cycles.

Long-term analysis

For an investment it is crucial,

- which return on investment can be expected over the lifetime of a battery and

- how a battery is dimensioned.

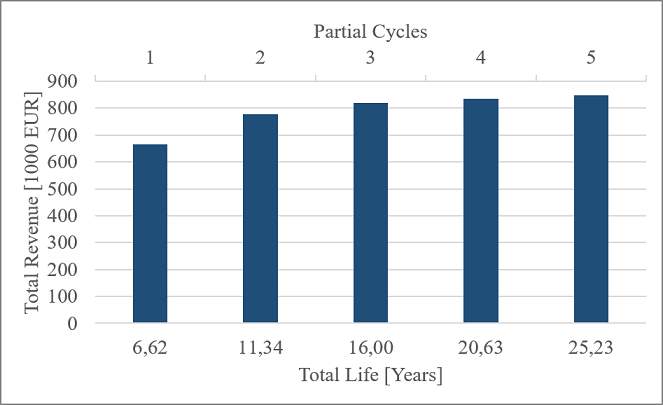

Figure 4: Long-Term Effect of the Number of Partial Cycles

With 10,000 full cycles, the battery lifetime at maximum utilisation of the charging and storage capacity would correspond to around 6.6 years according to Figure 4. With increasing number of partial cycles, lifetime and revenue potential increase. However, the change in yield over time makes it clear that the battery should be operated at maximum utilisation of the power capacity: Even with current acquisition costs of around 375 kEUR/MWh [7], replacing the battery after 6.6 years leads to a higher yield than operating the battery in more partial cycles. If battery costs fall to between 200 and 300 kEUR/MWh by 2030, cost efficiency will increase further.

Figure 5: Sensitivity Analysis of Storage and Charging Capacity

In the following, storage capacity and charging capacity are compared in order to achieve the most efficient support possible for the system. Figure 5 shows on the left the revenue per MWh when the charging capacity and the storage capacity are adjusted in relation to the originally assumed 1MW/1MWh battery. On the right is the ratio of full cycles in relation to the originally assumed 1MW/1MWh battery. From the operator's point of view, the 1MW/1MWh ratio offers the highest revenue potential. Exceptions are only batteries with a larger storage capacity if they are always used at full charging capacity.

The flexibility of the battery, on the other hand, is decisive for grid efficiency. More full cycles per unit of time increase system efficiency. As expected, batteries with a higher charging capacity have an advantage here. However, it is noticeable that these remain below their power factor. This means, for example, that two 1MW/0.5MWh batteries are preferable to one 2MW/1MWh battery.

Conclusion

Various forms of system balancing support are common practice outside Germany. System balancing support offers decisive efficiency advantages compared to absolute balancing group loyalty. This is because it can make sense for another balancing service providers to compensate for imbalances due to individual technical possibilities. Beyond, it can also make sense from a system perspective to allow system balancing support. This said, it should not be ignored that the majority of balancing groups cannot be interested in system imbalance.

By applying the example of a battery, it can be shown that batteries perfectly suit the requirements for system stabilization and thus reduce the need for balancing energy - even when using an independent signal for activation, the Gridradar aFRR directional forecast. Even providing pure system stabilization support represents a business case for battery operators.

Against the backdrop of new flexibilities, the adherence to unconditional balancing group loyalty must be scrutinised. It is undisputed that allowing system supportive behaviour requires a regulatory framework in Germany which can be adapted to the changing market and system situation over time.

Endnotes

(i) A description of the Gridradar aFRR direction forecast can be found here: https://gridradar.net/en/blog/post/forecasting-model-for-the-direction-of-afrr-activation-in-germany

(ii) The first aFRR direction forecast already matches the actual aFRR call-off direction by 75 percent.

(iii) These restrictions form the baseline for the use of batteries. This is because they cannot be optimised over several markets and they cannot be optimised over time. Due to the scalability of batteries, the restriction to 1MW/1MWh has been chosen for illustrative purposes only.

(iv) One exception, for example, was 3 June 2024 with the high reBAP of around EUR 15,000/MWh in several quarters. Here, a higher number of partial cycles would have increased the revenue.

Literature

1 Federal Network Agency, 2020a: Standard balancing group contract

2 Federal Network Agency, 2024: Standard balancing group contract

3 Federal Network Agency, 2020b: Position paper balancing group loyalty

4 Ocker, Fabian and Karl‐Martin Ehrhart, 2017: The „German Paradox“ in the balancing power markets, Renewable and Sustainable Energy Reviews 67, p. 892‐898

5 Koch, Christopher and Lion Hirth, 2019: Short‐term electricity trading for system balancing: An empirical analysis of the role of intraday trading in balancing Germany’s electricity system, Renewable and Sustainable Energy Reviews 113, p. 1‐11

6 Wessling, Hendrik, 2021: Bilanzkreise: Der Bewirtschaftungsgrundsatz des „aktiven Mitregelns“ und Transparenzpflichten der Übertragungsnetzbetreiber, Recht der Energiewirtschaft 69, S. 61‐75

7 Wille‐Hausmann et al., 2022, Fraunhofer ISE Positionspapier: Batteriespeicher an ehemaligen Kraftwerksstandorten

(Picture: Beech Ridge Energy Storage System 20241107 Invenergy_Beech_Ridge_Energy_Storage_System.jpg, author: Z22, CC BY-SA 4.0)