Number 4

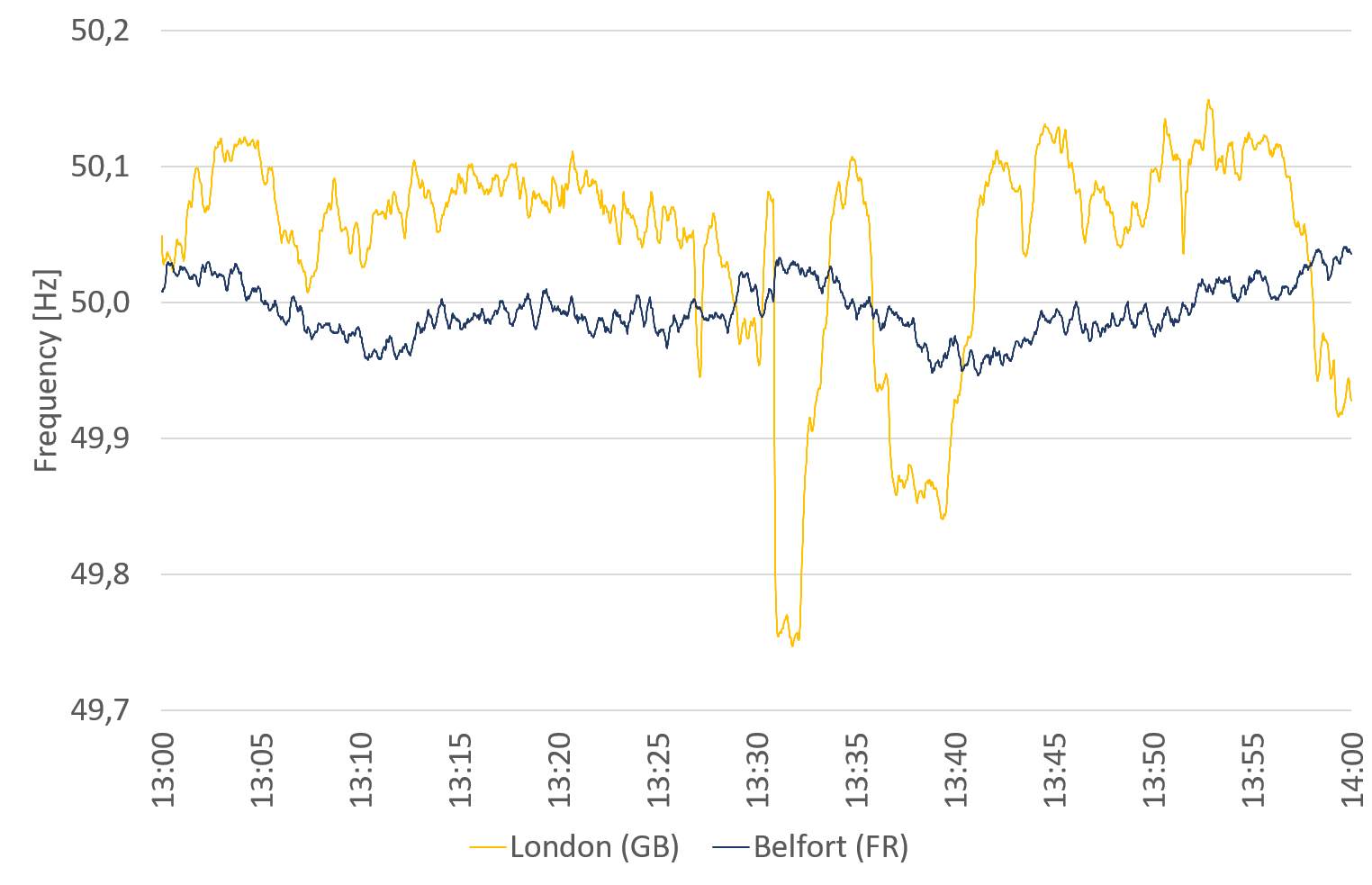

They have almost become the norm: On 12 December 2023, another unplanned interconnector split occurred. This time it affected the ElecLink, which transports 1000 MW through the Eurotunnel between France and the UK. As the following figure shows, the grid frequency in the UK dropped by around 300 mHz between 13:30:53 and 13:31:00 (UTC).

Figure 1: Frequency Comparison UCTE - UKTSOA

In Continental Europe, there was a slight frequency jump of around 30 mHz. This confirms the now published export drop of 1000 MW from Continental Europe to the British system. At the time of the outage, the connected instantaneous reserve or synthetic instantaneous reserve in Continental Europe was evidently around 10 times greater than in the UK. According to Gridwatch publications, the net export from the UCTE to the UK synchronous area via ElecLink at the time of the outage was almost a quarter of the total net export.

Effects in the British system

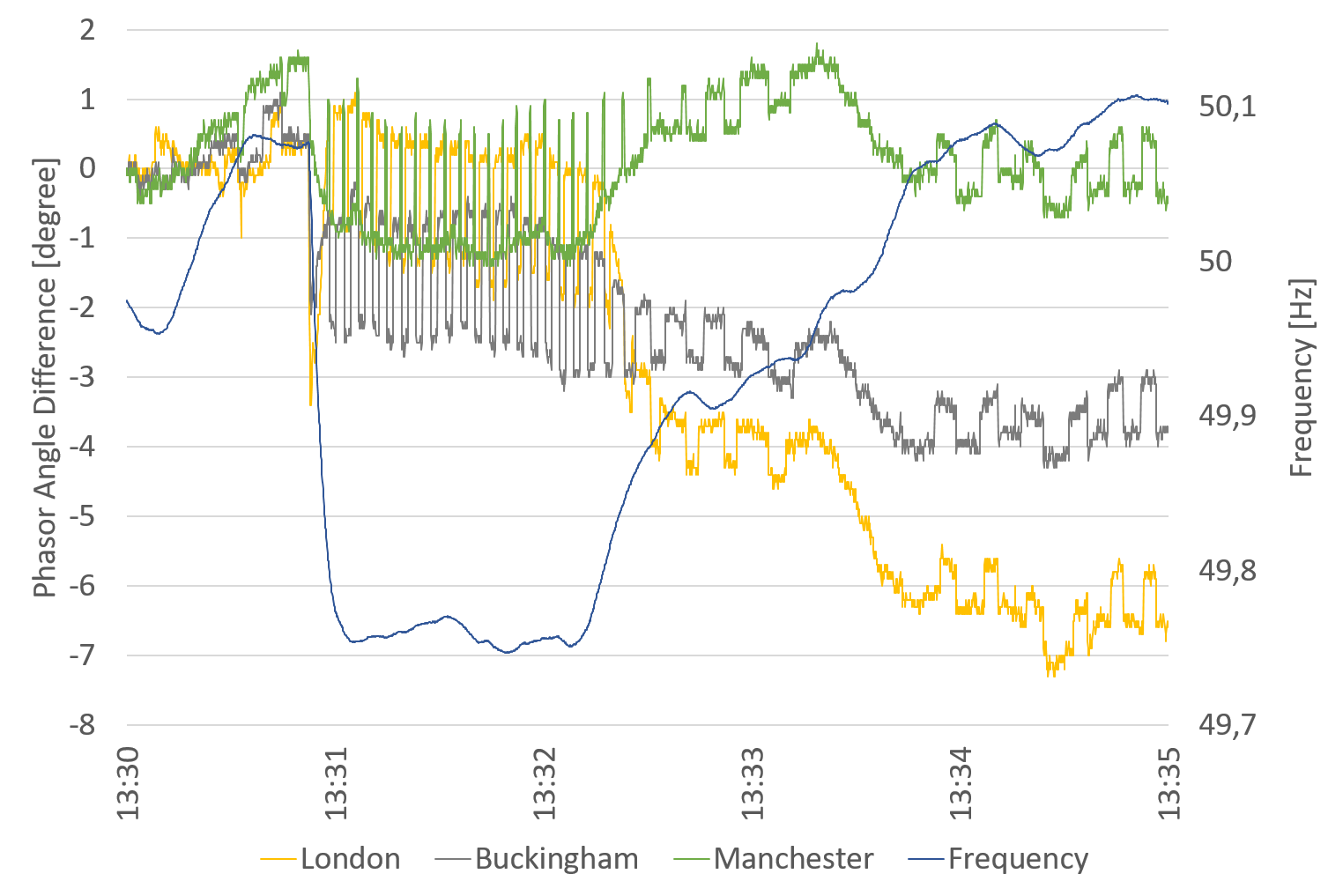

From our point of view, the most exciting thing is to look at the effects in the UK grid area. Figure 2 shows the phase angle difference between our measuring stations in London, Buckingham and Manchester and Strathclyde in the North of the island.

Figure 2: Direct Impact of the Split in the UK system

The loss of the interconnector has obviously had a greater impact in the South of England. The region around London is of central importance here. Figure 2 shows that the failure of the interconnector triggered an oscillation in the British grid. Initially, there was a short-term drop in the phase angle at the beginning of the frequency drop. The height and width of the amplitudes show that the oscillation was strongest in the South-West of England and then decreased continuously towards the North and North-East. After almost exactly 1.25 minutes, the countermeasures took effect, with generation plants further North in particular being able to stabilise the grid again.

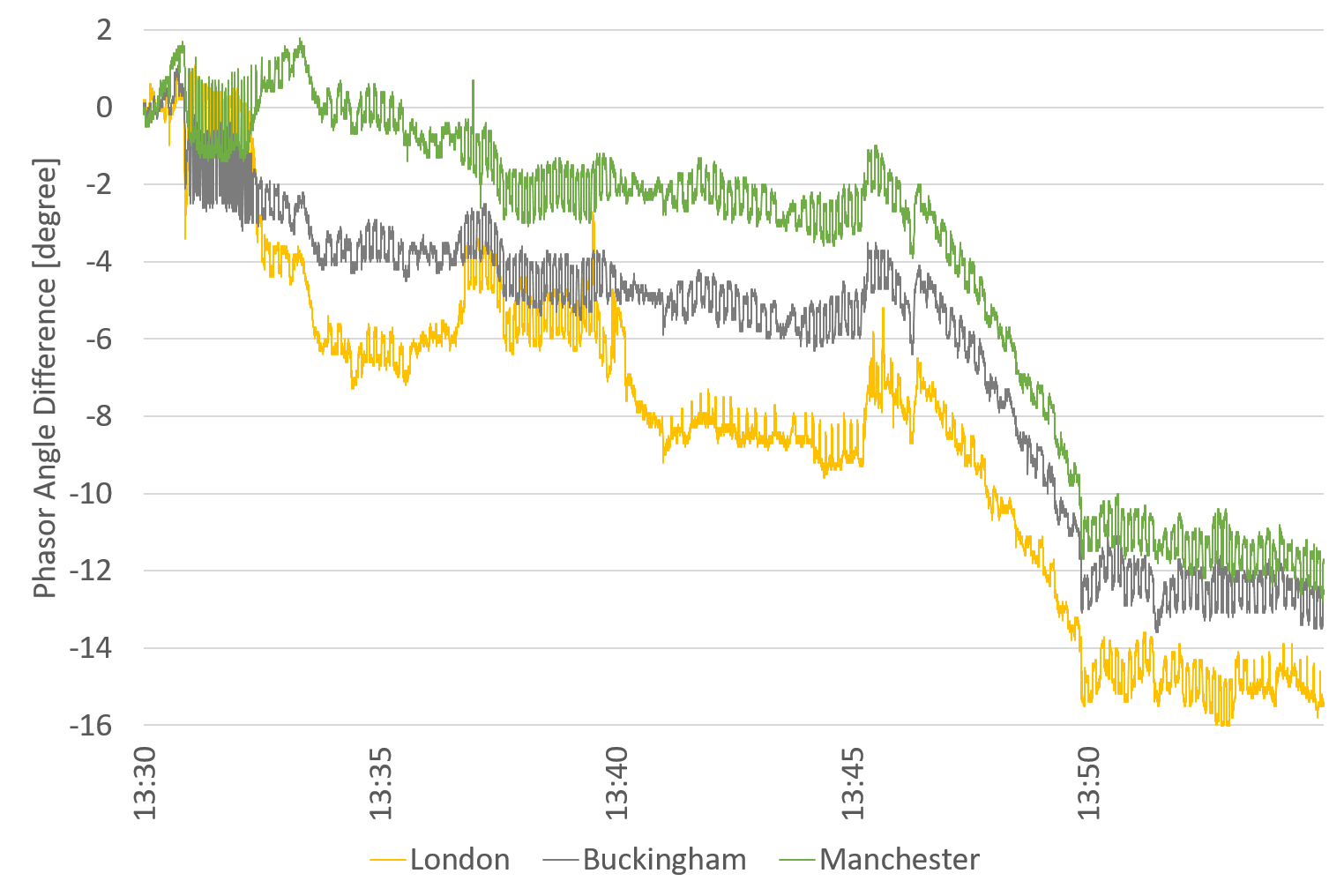

Only after around 20 minutes did the imbalance between more Northerly grid sections and in the South-West and the region around London return to a normal level. This can be seen in the longer- term development of the phase angle difference (see Figure 3).

Figure 3: Longer-term Effect of the Split in the UK system

Has the interconnector failure had an impact on the market?

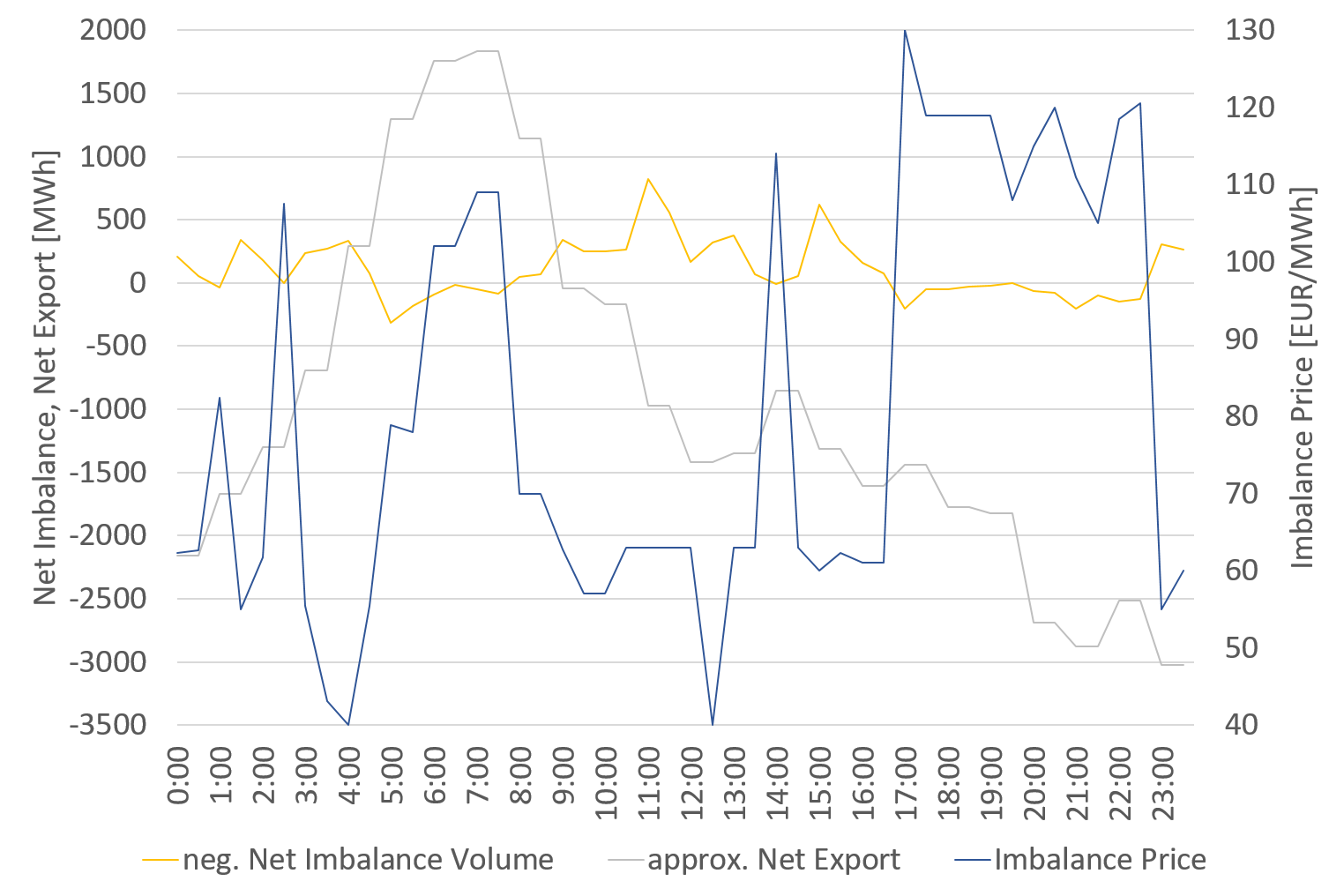

As the previous comments show, there was a massive frequency collapse in the UK grid area, which had very different effects locally. It is not yet clear whether this has also had an impact on markets and what effect such an event has on generators, storage facilities and large consumers. While day- ahead trading is already closed, such an event is reflected in the shorter-term markets. We have looked at the balancing markets as an example. Figure 4 provides a summary of the events there in connection with the exchange between Great Britain and the neighbouring synchronous areas. 1. the system imbalance, i.e. the missing or surplus energy quantities in the British system, 2. the balancing energy price, i.e. the price for the necessary procurement or reduction of the missing quantities, comparable to the German reBAP, and 3. the net export. The net export corresponds to what was exported from the UK grid area minus what was imported into the UK grid area in the same period. [Note: The half-hourly values were approximated by evenly distributing the hourly values, as apart from the Dutch exchange, only hourly values are published on a comparable basis].

Overall, the UK grid area was largely short on 12 December 2023. It is striking that the system showed overproduction in the hours before and after the outage. Therefore, in the longer-term view in Figure 4, it even appears as if the interconnector outage coincidentally had a supportive effect on the system. This is because it reduced overproduction to almost zero during the period of the outage. However, the balancing energy price reflects the actual effect: During the outage period, it shot up from 63 to 114 EUR/MWh and fell back to 63 EUR/MWh in the half hour following the outage.

There was therefore enormous revenue potential for short-term players such as flexible suppliers or battery storage systems if they had reacted quickly and early to the interconnector failure.

Figure 4: System Imbalance, Net Export and Imbalance Price

Main Takeaways:

Unexpected interconnector outages occur more frequently. In the last six months alone, we were able to identify four major outages and a number of smaller ones in our alert system, which were subsequently officially confirmed.

The outages have a huge impact in the UK, less in Continental Europe and less in Scandinavia. They typically have a greater impact in smaller systems with less inertia.

The outages offer enormous potential, especially for modern, highly flexible traders. After an outage, typical market transactions even have a system-supporting effect. This is because shortfalls due to an outage lead to high price signals in the short term and thus to a necessary local equalisation of the shortfalls.