Opportunities for flexibility in system stabilisation

Potential is currently opening up for new market players such as BESS providers and flexibility aggregators. TSOs want to use these capacities to stabilise the system and are creating new products. In addition, new players are also becoming involved in the area of system stabilisation by exploiting their high adaptation speed in conjunction with sophisticated AI models. The following compares the status quo and the potential of the three major European synchronised areas for such new market players in terms of system stability.

Background

Currently, new market players such as battery marketers and flexibility aggregators are increasingly approaching Gridradar. Due to their high adaptability, it is less important to them which market they enter. Instead, they are looking for the greatest market opportunities for their AI-supported business models. However, this also creates opportunities for transmission system operators (TSOs). This is because the highly flexible generation, storage and consumption technologies can react much faster to system fluctuations than previous technologies. To utilise these new technologies, TSOs now need to set the right course and cast their flexibility requirements into corresponding products.

The following section will first compare system stability between continental Europe, the UK and Scandinavia. The status quo in terms of flexible system services will then be analysed and finally the further potential will be discussed.

Overview: System stability over time

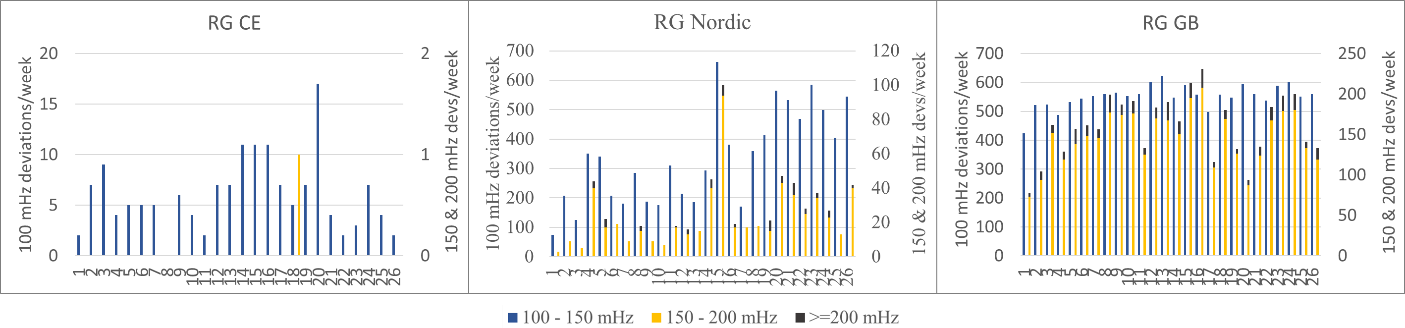

For a better understanding of the differences in terms of system stability, the three synchronous areas of continental Europe, the UK and Scandinavia will first be compared on the basis of frequency data for the first half of 2024. Figure 1 shows the weekly number of deviations from the 50Hz target frequency per synchronous area grouped into deviations from 100 to 150 mHz, from 150 to 200 mHz and over 200 mHz as a measure of system stability.

Figure 1: Frequency deviations per synchronisation area

The significantly different distribution of frequency fluctuations is striking: While there are only minor deviations in continental Europe, there are over 330 deviations in Scandinavia and even over 550 deviations of up to 150 mHz in the UK (blue bars). Larger deviations occur in similarly different ways. In Great Britain, deviations above 150 mHz are 6.6 times higher than in the Scandinavian synchronous area (yellow and grey bars). This simple comparison shows how important grid load, production mix and distribution are for system stability. This is because the UK, with the smallest of the three grids, fluctuates significantly more than Scandinavia and continental Europe in all frequency ranges.

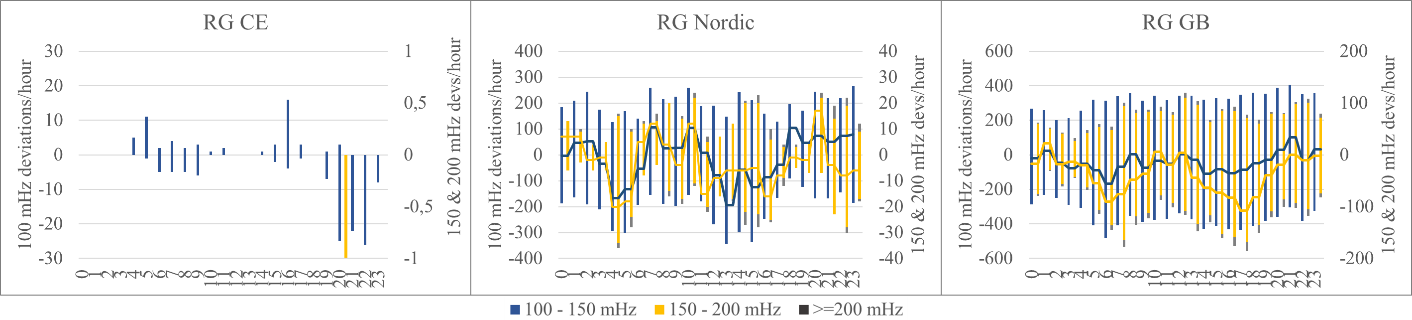

The fact that these fluctuations can represent different potential for a business case for flexible providers is shown by the resolution of the frequency over the day (Figure 2).

Figure 2: Frequency of frequency deviations throughout the day

While the deviations in continental Europe are quite clearly divided into positive and negative deviations for individual hours of the day, larger frequency deviations in both directions occur in Scandinavia and the UK every quarter of an hour. Time-of-day trends in Scandinavia are shown by the solid lines with a tendency towards greater deviations in a negative direction in the morning and afternoon. In Great Britain, positive and negative deviations are more frequent in the morning and early evening hours.

Duration of deviations

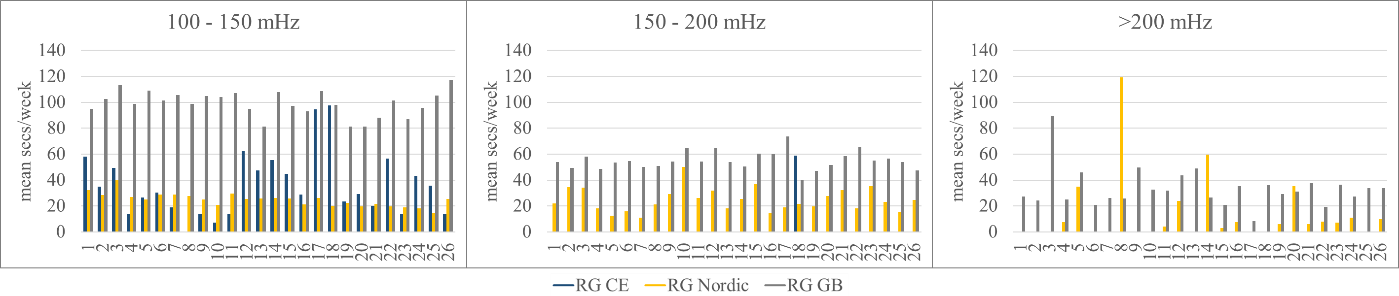

In addition to frequency and predictability, the duration of the call-off is of key importance for flexibility providers. This is because batteries must, for example, be able to release energy absorbed as part of system-serving behaviour in order to be available again for ancillary services. It is therefore important how long a charging or discharging cycle lasts, i.e. how long system deviations are on average.

Figure 3: Duration of frequency deviations

Figure 3 compares the duration of deviations as the period from the frequency deviation to the return to 50 Hz. The significantly longer duration of deviations in Great Britain between 100 and 150 mHz is striking. In continental Europe and Scandinavia, on the other hand, deviations are much shorter and their duration is almost the same over time, regardless of the deviation. This means that batteries for fast frequency support in the UK should be larger in terms of both power and storage capacity than in continental Europe, for example.

System service products

In the past, ancillary services were developed in such a way that they can optimally map the grid-specific fluctuations. Therefore, ancillary services such as FCR, aFRR, mFRR and RR are differentiated, for example, in terms of the required availability period and inertia in provision. As a more inert ancillary service, aFRR replaces FCR, mFRR replaces aFRR and RR replaces mFRR. Despite European standardisation and integration in many control areas, the required call-off times are currently still based on the availability and capabilities of conventional generators.

The declining profitability of conventional generators in times of renewable energy expansion has a double impact on system stability: On the one hand, their dismantling leads to a lack of physical flywheels, which until now have guaranteed system stability. On the other hand, new system stabilisation products must now be developed in such a way that they can compensate for new forms of frequency fluctuation patterns with steeper edges and larger deviations. In addition, the products must also be able to be provided from new flexibilities with faster but shorter availability.

The UK, for example, has been incentivising short-term available capacities since 2016. Flexibility products have been continuously developed and adapted to the changing grid situation over time. Another market, Quick Reserve, will be launched in November 2024. The consultation phase for several new dynamic services was completed at the end of July 2024. The products will be launched in 2025. Scandinavia and continental Europe are relying more heavily on the integration of the consumption side to stabilise the system. However, the requirements and products for system services must also be adapted for this.

Lessons learnt from the comparison

The comparison across the three synchronous areas shows the technical potential and provides indications of the potential for new market players in ancillary services. Regular adjustments to frequency response products in the UK show the already necessary demand on the system side and the high market volatility, particularly in short-term demand due to reduced inertia. However, the greater integration of the consumption side in Scandinavia also indicates a growing need for system-side flexibilisation, which offers new market opportunities for aggregators in particular. In the large countries of continental Europe, on the other hand, the potential of new technologies could be utilised to a greater extent at a time when conventional generators are being dismantled.

- The analysis shows that the UK, followed by Scandinavia, offers particular potential for providers of flexible capacities due to the large number of major frequency fluctuations. This results in different options for batteries as a standalone solution or for buffering in the sense of system support for less flexible producers or consumers.

- Batteries are considered to be particularly suitable for providing synthetic flywheel mass due to their flexibility in adapting the driving style. Corresponding products already exist in the UK and Scandinavia.

- In terms of system relief, flexibilities can utilise longer-lasting frequency deviations in order to behave in a system-friendly manner and thus generate revenue with the balancing energy price, so-called "NIV chasing". However, due to the requirement for balancing group loyalty, active NIV chasing is not permitted in Germany, unlike in the UK or the Netherlands, for example.

Conclusion

For aggregators and battery marketers, current adjustments to the balancing power/energy markets are creating new business cases in the UK, but also in Scandinavia and, in the foreseeable future, in continental Europe. This is because we are seeing frequency fluctuations change as a result of the decommissioning of large flywheel masses.

Gridradar has set itself the goal of providing aggregators and battery marketers with the right information at the right time. We have therefore expanded our product range in terms of short-term forecasting in the areas of grid stability, control power call-offs and alerts. However, we also work with our customers to develop complete optimisation solutions for batteries, new flexibilities such as greenhouses or for distributed server farms.

Even if this is currently of lesser importance in continental Europe, TSOs should look towards the UK and Scandinavia. This is because batteries and new flexibilities offer opportunities for system stabilisation. However, for such providers to enter the market, the right products must also be available. The UK has been preparing the market for batteries since 2016. As of June 2024, there were 4.6 GW/5.9 GWh of batteries installed on the grid in the UK (Solar Media Market Research, 2024). In Germany, around 2.5 to three times this potential is available. Due to the accelerated expansion of renewables, German TSOs and the BNetzA should therefore consider how this potential can be integrated more strongly for short-term system stabilisation using appropriate products.

(Picture: Schwerin 20140923 wemag2.jpg, author: Enyavar, CC BY-SA 4.0)